Simple Guide to Raising Your Credit Score

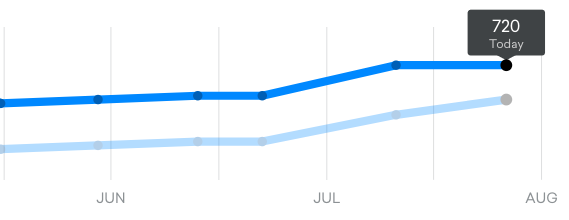

In the last year, I’ve helped my fiancé raise her credit score from ~580 to ~720, and my credit score is over 800. Credit scores are a number that lenders take into account when offering you loans, and can make a huge difference when buying a house. A high credit score will get you a lower interest rate, which can add up to tens of thousands of dollars over the life of a mortgage. It takes time to increase your credit score, but it is very simple to do.

Credit scores take into account many things, but one of the most important and easiest to change is credit utilization, which is how much you’ve spent vs how much you have available. The goal is to decrease the amount you owe, and increase the amount you can borrow.

1. Sign up for a credit monitoring service.

I recommend CreditKarma since it is 100% free and updates every two weeks. Lots of credit cards will provide credit scores and monitoring as well, but I still use CreditKarma. The goal is to see what lines of credit you have open, and things you can do to improve your credit score. When checking my fiancé’s, we found out she was an Authorized User on one of her parents cards with high utilization. We got her parents to remove her from that, which helped decrease the overall utilization of her lines of credit, which helped increase her credit score. You might find something on your credit report you did not know about!

2. Start getting Credit Cards

If you’re just starting out with credit, you’ll want no annual fee, easy to obtain credit cards. The first three credit cards my fiancé got were no annual fee, easy to get, simple rewards, and we applied for them about 3-4 months apart. These 3 cards are considered some of the best beginning cards. When you get your card, setup auto-pay and link them into your Personal Capital account, which is also highly recommended.

-

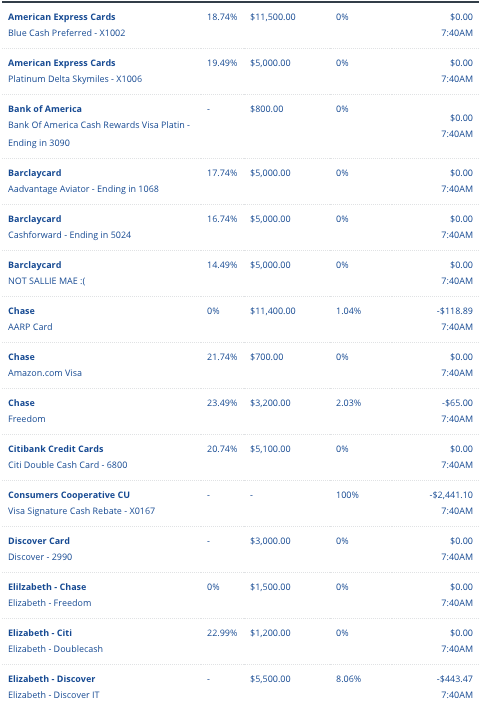

Chase Freedom - $150 sign on bonus, 1% back on all purchases, 5% on rotating categories. My fiancé got a $1,500 line of credit on this one, her first card.

-

Citi Double Cash - No sign on, but 2% back on all purchases. My fiancé got a $1,200 line of credit on this one, her second card, so now she had $2,700 of total credit.

-

Discover IT - $50 sign on bonus, 1% back on all purchases and 5% on rotating categories, just like the Chase Freedom, HOWEVER! Your first year, Discover matches all your cash back, which effectively makes this a 2% everything, 10% rotating categories card for 1 year. My fiancé got a $5,500 line of credit on this one, her third card, so now she has $8,200 of total credit.

Note that her total credit available is increasing substantially, but her spending stays about the same. If she spent $1,000/mo, with her only 1 credit card, she is using $1,000 / $1,500, or ~67% of her total credit. Now that she has 3 cards and more available credit, her new credit utilization is $1,000 / $8,200, or just 12% of her credit. It’s best to keep this number as low as possible.

3. Other Things

- Keep your Cards Open

You should always keep your no-annual fee credit cards open, even if you stop using them, since it will increase the average credit line age. One of my favorite cards, the Sallie Mae Barclaycard, removed the majority of good cash back benefits from the card. I still have the card open, but haven’t spent a penny on it since then.

- Be reasonable when applying for new cards.

Don’t apply for credit cards you don’t think you’ll get approved for.

- Keep Tabs on Your Spending

Always track your cards, in Personal Capital or in Mint. You can see some of my cards and their credit limits below.

- Bills in Your Name

Some other things you can do to increase your credit is to have utility bills in your name, so if you’re renting a house, put the utilities in your name. Always set up auto-pay to make sure your bills are paid in full, every month. Months and years of no missed payments will help your credit as well.

If you start getting into the world of Annual Fee cards and churning, this guide might not be for you. :) For further reading see, /r/churning, this is for those who don’t mind juggling 20+ cards to gain tons of airline miles and points, not for the faint of heart.

These simple steps will help get your credit score up and will save you money when applying for loans that matter, such as car and home loans. My 800+ credit score helped me secure a low mortgage rate (3.25%) and a low car loan rate (1.49%). A high credit score will save you money over time, and is simple to get high and keep high.

Any other tips? Leave them in the comments!