Matching Your Net Worth with Your Lifetime Earnings

A cool metric to track your net worth is against your lifetime earnings, of which you can pull from your social security income. I first heard of this from Retire By 40, which he calls your Lifetime Wealth Ratio. Basically, it’s a way to how well you are investing, or if you’re overspending. I decided to run mine and see!

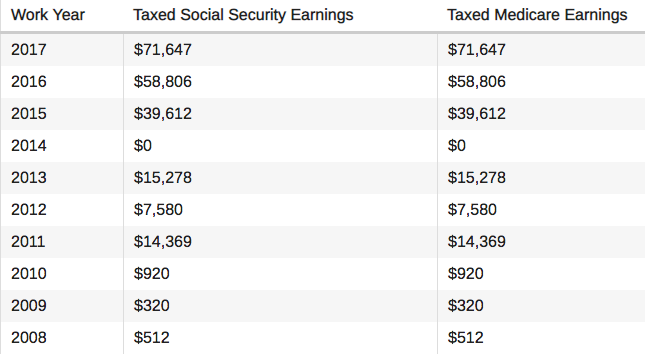

Social Security Earnings

You can get your social security earnings from the Social Security website, which I signed up for a few years ago, and my figures are below. Note that I worked at a water treatment plant making $8/hr in the summers of 2008, 2009, and 2010. In 2011, 2012 and 2013 I worked 3-5 months per year at an engineering co-op, earning $15.50-$18/hr. I didn’t work in 2014 (still in college), then started my first professional job in May 2015. I switched jobs for a 35% raise in February 2017.

So 2008 to 2017, I made $209,044. Added in with my latest paycheck (August 2018), I’ve made $48,305 this year. This brings my lifetime total to $257,349.

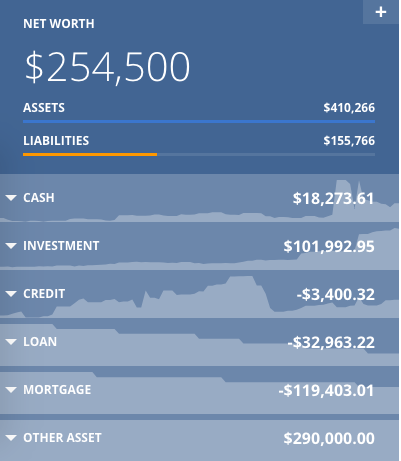

Current Net Worth

My current net worth is $254,500 (tracked with Personal Capital), which means I’m $2,805 BEHIND my Social Security reported income. However, I’m at a 98.9% ratio of net worth to lifetime income, which is pretty good at age 26.

How?

The main reason my ratio is this high is because of my great single real estate purchase. I purchased a 4 bedroom single family home in May 2016 for $170K, which is my primary residence. I’ve had 2-3 roommates for the last few years which almost cover my mortgage, which was a 15 year mortgage with 20% down. The house has also appreciated to about $250K, thanks to a strong market and lots of sweat equity.

I’d also like to acknowledge how my family has helped. My dad gave me $5K to help on the down payment on my house, and loaned me $30K to pay back as I could. I paid it back in less than 6 months after downgrading my car and putting every penny towards it. I also recently received a $25K life insurance check from my grandfather passing. 100% of that was put into investments and savings. Both of these benefits gave me a head start, and its something I’m very thankful for.

So I’m doing pretty well at 98.9% of my lifetime earnings still attributed to me in assets, investments, or cash. How are you doing?