High Interest Checking Account

Most people keep a bank account to pay their bills, mortgage, credit cards, loan, etc. My checking account is used to pay my mortgage, credit cards, and other bills on auto-pay, and distribute money into various investments. Most people utilize a basic checking account which earns little to no interest. In fact, most big name national banks only give .01% interest! I use a little known credit union in Illinois, even though I live in Florida and have never visited the bank in person.

The credit union is Consumers Credit Union (CCU). They have a high interest checking account that gives 3.09% interest on up to $10,000 and no ATM fees. There are a few hoops you have to jump through to get that high interest rate, which are easy to manage and VERY worth your time.

-

Get one direct deposit per month. Easy, just setup some or all of your workplace paycheck to use this bank. The majority of my paycheck goes here every other week.

-

Access online banking once per month. This is easily accomplished using finance aggregation websites, such as Personal Capital or Mint. I prefer Personal Capital for wealth management, but I think Mint is better for budgeting. I used Mint throughout college to get a better grasp on finances, though I made the switch to Personal Capital in 2016 when I discovered Mint couldn’t track my mortgage.

-

You also need to elect to receive eDocuments. Sure, easy, no one wants more snail mail.

-

Finally, complete 12 pin-less debit transactions. This is the only one that requires effort. For this, both my brother and I have our CCU debit card linked to Facebook Messenger. Every month, we send each other 12 individual one cent transactions. Each one registers as a pin-less debit card transactions, and our obligations are met!

This yields me about $30-50 per month just off of my money I have in a holding pattern, waiting to pay off my utility bills, credit cards, and mortgage. There are a few small tasks you have to setup to take advantage of the higher interest rates, but are well worth checking out. If you don’t meet all of the above, you still earn .01%, which is normal for big banks.

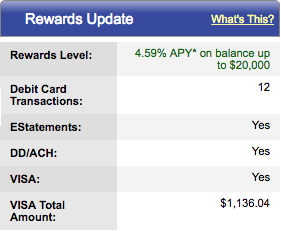

Higher Interest Accounts

They even have a few tiers of higher interest checking accounts available, but those require you to use the CCU Visa Signature Cash credit card. If you get their credit card and spend $500/mo on it, you earn 4.09% interest on up to a 15k balance. If you spend $1,000/mo on their credit card, you earn 4.59% interest on up to a 20k balance. I’ve been using the credit card for a few months, and usually spend a little over $1,000 on it to get the best interest rate.

Credit Card

The CCU credit card also offers 3% back on grocery stores, 2% on gas, and 1% on everything else. My favorite thing about this credit card is that all rewards accumulated over the month are automatically applied to your statement. Unlike Discover, Chase, Amex, etc, you don’t have to manually login to redeem rewards in $25 increments! It requires a hard pull on your credit, but has been very worth it for me so far.

Loans

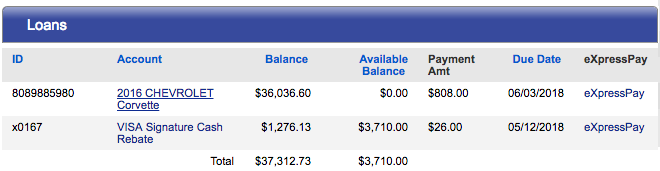

I also use a car loan through Consumers Credit Union, which I talked more about in my Turo Review. I took a ~$37,000 used car loan for 48 months at 1.49% interest, which is REALLY low for a used car. These payments come out every 2 weeks from my checking account. Notice you can also check your CCU credit card statements from the loan section.

Downsides

I have found a few downsides for using Consumers Credit Union. Checks cost money, which I think is normal now, and also I can’t deposit cash. The CCU app lets your deposit checks using pictures, like most major banks, but there is no way to deposit cash when you live in Florida and all the physical locations are in Illinois. I have a local credit union that I deposit my cash into, but I don’t keep much money there since the interest rate is only .01%. If you don’t want to jump through a few hoops, you can earn over 1.5% at Ally Bank, which I recommend as a good place for your emergency fund!

Do you use a different or better account for your money? Let me know in the comments!